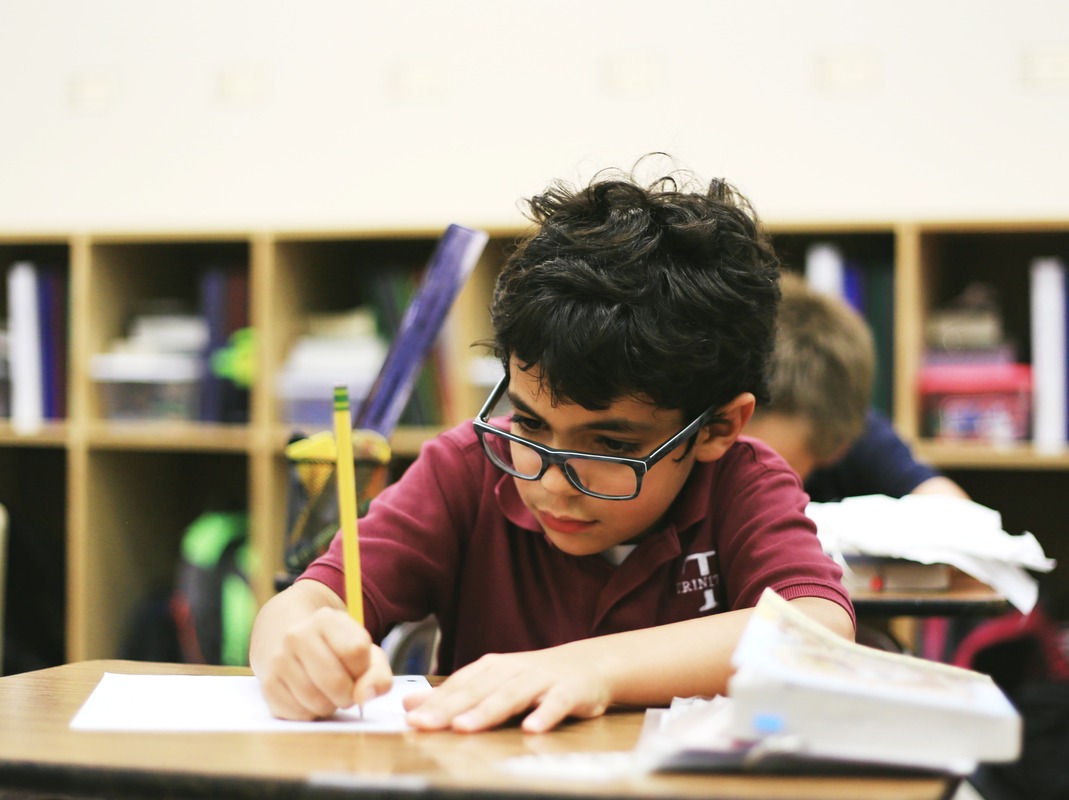

Since its founding in 1999, Trinitas has been blessed with friends and family who have, in faith, given generously so local families could have an excellent Christ-centered and classical education.

Financial donations to Trinitas not only provides for immediate needs of the students and faculty, but also for future opportunities as Trinitas continues to grow. Every investment made in the mission of Trinitas directly impacts the Pensacola community and beyond as students and graduates share the fruit of the exceptional education they receive.

Essentials operational needs of the school, including professional development, curriculum enhancements, support for the arts, technology investments, athletics, and other activities are provided for by the Trinitas Annual Fund. Unrestricted gifts are applied wherever the need is greatest and are essential to the school’s financial strength. Restricted gifts allow donors to align their giving with their passions within the scope of the school’s established programs.

Many local businesses generously support Trinitas by participating in the Benefactor Portfolio. These companies provide many useful products and services. With gratitude for their kindness to Trinitas, please consider patronizing these Trinitas supporters.

These are just a few of the many ways you may support the Trinitas mission.

The majority of gifts made to Trinitas come in the form of cash, check, or credit card since a they receive the most generous federal income tax deduction available for charitable contributions. Especially helpful are donations that are set-up to occur monthly.

A gift of appreciated securities that you have held for more than one year is frequently the most tax-wise way to give securities. You will be eligible to make a federal income tax deduction equal to the fair market value on the date of the gift for up to 30% of your adjusted gross income and will recognize the appreciation as capital gain.

In exchange for a gift, Trinitas will contract to pay a fixed and guaranteed income to the donor for their lifetime. Income payments may be received immediately for life or deferred to a future date.

CLT’s allow Trinitas to receive income from the asset a donor contributes to the trust for a term of years. At the end of the designated period, the assets of the trust pass to those named by the donor (typically younger children or grandchildren) which significantly reduces estate and gift taxes.

Double the impact of your generosity through corporate charity gift matching programs. Contact the human resources department of your employer to find out if they participate in such a program.

A gift of appreciated marketable real estate will entitle you to a federal income tax deduction equal to the qualified appraisal of the value of the property. Gifts of real estate must be reviewed in advance by the Board of Governors.

An individually-managed trust that may be tailored to the specific needs of the donor or designated beneficiaries. These trusts can be structured to provide income for life or for a term of years. Most importantly, the trust assets can be managed for income or growth, depending on a beneficiary’s needs.

Ensure your support for Trinitas continues beyond your lifetime by a directing a bequest in your will, designating Trinitas as a beneficiary of your life insurance policy, or establishing a named endowment. Such legacy planning options can be altered at any time and provide the confidence of knowing that your philanthropic desires are honored.

To explore any of these giving opportunities, please contact an estate planning professional or James Cowart in the Trinitas Office of Development at 850-484-3515 or jcowart@trinitaschristian.org.

3301 E. Johnson Ave. Pensacola, FL 32514

©2021 Trinitas Christian School. All Rights Reserved.